Cellectis Supplements the Announcement of the Pricing of Follow-On Offering with Allocation of Share Capital Information

Published on February 03, 2023

NEW YORK—February 3, 2023 — Cellectis S.A. (“Cellectis” or the “Company”) (Euronext Growth: ALCLS - NASDAQ: CLLS), a clinical-stage biotechnology company using its pioneering gene-editing platform to develop life-saving cell and gene therapies, in accordance with French regulatory requirements, is supplementing its previous announcement of the pricing of its underwritten global offering by way of a capital increase of 8,800,000 American Depositary Shares (“ADS”), each representing the right to receive one ordinary share of Cellectis, nominal value €0.05 per share (the “Global Offering”), which launched and priced on February 2, 2023, at a price to the public of $2.50 per ADS as announced on February 2, 2023. The closing of the Global Offering is expected to occur on or about February 7, 2023, subject to customary closing conditions.

Jefferies LLC and Barclays Capital Inc. are acting as joint book-running managers for the Global Offering.

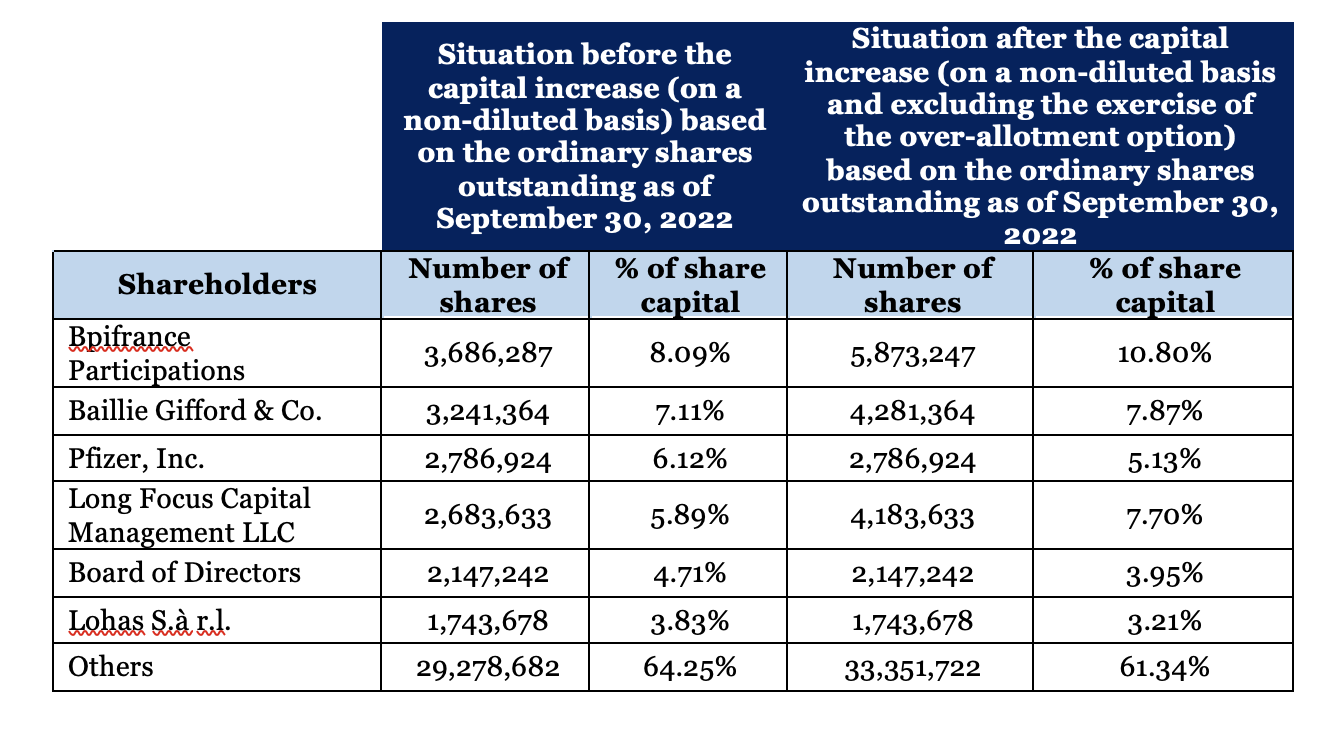

Allocation of the Share Capital

The following table presents the expected allocation of Cellectis’ share capital following the settlement and delivery of the ADSs sold in the Global Offering:

Bpifrance Participations, Baillie Gifford & Co. and Long Focus Capital Management LLC, existing shareholders of the Company, are expected to be allocated in the aggregate more than half of the ADS sold in the Global Offering.

The listing of Cellectis’ ordinary shares on Euronext Growth in Paris were suspended at market open today, February 3, 2023, and will resume today at 3:30 pm (Paris time) / 9:30 a.m. (New York time).

The ordinary shares underlying the ADS offered in the Global Offering are expected to start trading on or about February 7, 2023 on Euronext Growth in Paris on the same trading line as the existing ordinary shares under the same ISIN code FR0010425595 and under the ticker “ALCLS”.

The ADSs are being offered pursuant to an effective shelf registration statement on Form F-3 (Registration No. 333-265826), which was filed with the Securities and Exchange Commission (SEC) on June 24, 2022 and subsequently declared effective on July 7, 2022. The Global Offering is being made only by means of a prospectus and prospectus supplement that form a part of the registration statement. A preliminary prospectus supplement relating to and describing the terms of the Global Offering has been filed with the SEC on February 2, 2023 and is available on the SEC’s website at www.sec.gov. The final prospectus supplement relating to the Global Offering will be filed with the SEC. When available, copies of the final prospectus supplement (and accompanying prospectus) relating to the Global Offering may be obtained from Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, 2nd Floor, New York, NY 10022 or by telephone at (877) 821-7388 or by email at Prospectus_Department@Jefferies.com; or Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, or by telephone (888) 603-5847 or by email at Barclaysprospectus@broadridge.com The preliminary prospectus supplement and the accompanying prospectus, together with the documents incorporated by reference therein do not include any inside information (as defined under Article 7 of Regulation (EU) No 596/2014 of the European Parliament and of the Council of April 16, 2014 on market abuse as amended (MAR)).

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. In particular, no public offering of the ADSs will be made in the European Union or any of its member states.